A Biased View of Real Estate Reno Nv

A Biased View of Real Estate Reno Nv

Blog Article

Real Estate Reno Nv for Dummies

Table of ContentsSome Ideas on Real Estate Reno Nv You Need To KnowSome Known Facts About Real Estate Reno Nv.The 15-Second Trick For Real Estate Reno NvReal Estate Reno Nv Fundamentals Explained

That might show up costly in a globe where ETFs and common funds might charge as little as zero percent for building a diversified profile of stocks or bonds. While platforms may vet their financial investments, you'll need to do the exact same, and that indicates you'll need the skills to analyze the possibility.Like all investments, genuine estate has its pros and disadvantages. Lasting appreciation while you live in the residential property Possible hedge against rising cost of living Leveraged returns on your investment Passive income from leas or with REITs Tax obligation benefits, including interest deductions, tax-free funding gains and devaluation write-offs Repaired long-lasting financing readily available Appreciation is not guaranteed, especially in economically clinically depressed locations Residential or commercial property costs may fall with higher rate of interest prices A leveraged investment indicates your down repayment is at danger May need considerable time and money to manage your own residential properties Owe an established home loan repayment every month, even if your renter doesn't pay you Lower liquidity for actual building, and high payments While actual estate does supply lots of benefits, particularly tax benefits, it does not come without considerable disadvantages, in particular, high payments to leave the market.

Do you have the sources to pay a home mortgage if a lessee can not? How a lot do you rely on your day task to keep the investment going? Readiness Do you have the need to serve as a proprietor? Are you ready to collaborate with tenants and understand the rental regulations in your area? Or would certainly you like to evaluate bargains or investments such as REITs or those on an on-line platform? Do you intend to fulfill the demands of running a house-flipping organization? Knowledge and abilities While lots of investors can find out at work, do you have unique skills that make you better-suited to one kind of investment than an additional? Can you evaluate supplies and build an attractive profile? Can you fix your rental building or repair a fin and save a package on paying professionals? The tax obligation benefits on genuine estate differ commonly, relying on just how you invest, yet buying realty can provide some large tax obligation advantages. Real Estate Reno NV.

The Best Guide To Real Estate Reno Nv

REITs offer an appealing tax profile you won't incur any type of funding gets tax obligations up until you offer shares, and you can hold shares essentially for decades to avoid the tax obligation male. You can pass the shares on to your beneficiaries and they won't owe any taxes on your gains (Real Estate Reno NV).

Realty can be an attractive financial investment, yet capitalists intend to make certain to match their sort of financial investment with their readiness and capacity to handle it, consisting of time dedications. If you're looking to create revenue throughout retired life, property investing can be one method to do that.

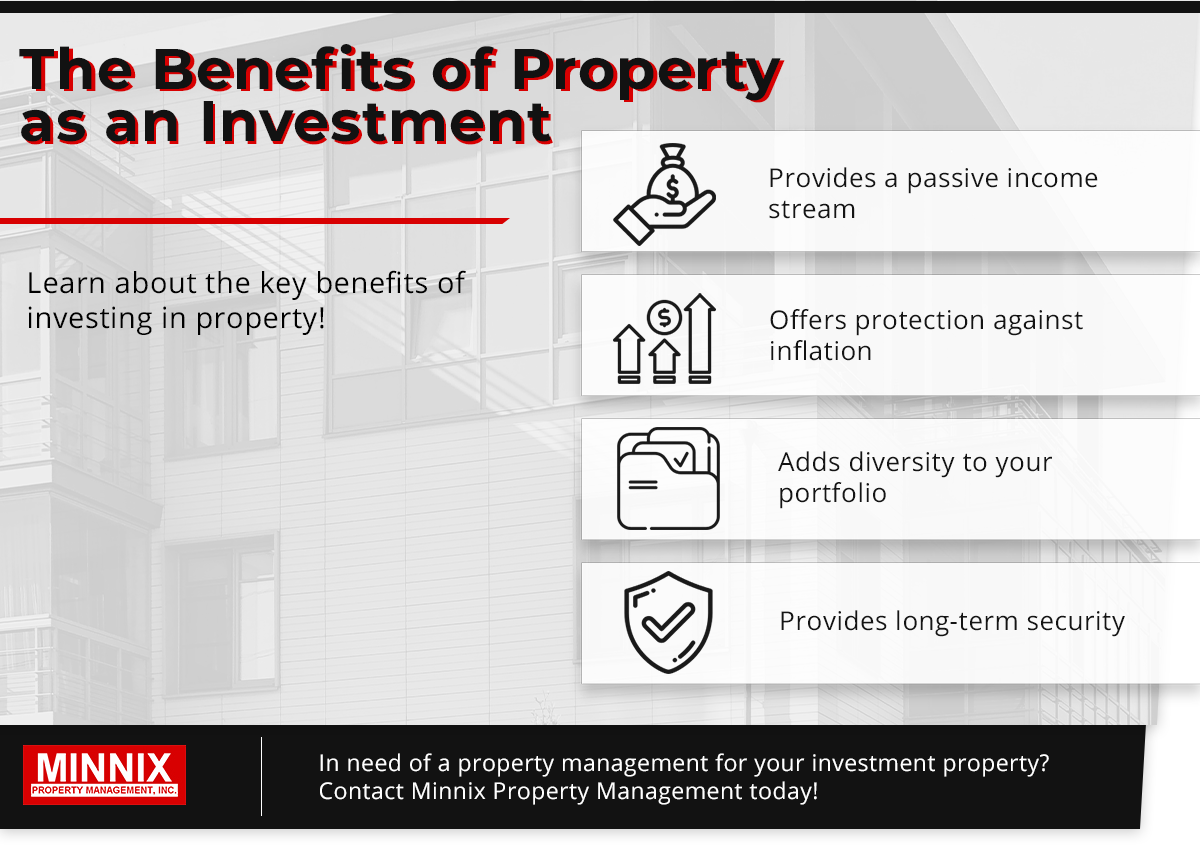

There are several advantages to buying property. Regular revenue flow, strong returns, tax benefits, diversification with appropriate properties, and the capacity to take advantage of riches via genuine estate are all advantages that investors might take pleasure in. Here, we delve right into the different advantages of spending in genuine estate in India.

Real Estate Reno Nv Things To Know Before You Buy

Property has a tendency to value in value with time, so if you make a smart financial investment, you can benefit when it comes time to offer. Over time, leas additionally tend to boost, which might enhance cash money flow. Leas raise when economic climates increase because there is more demand genuine estate, which raises funding go to website worths.

If you are still functioning, you might maximise your rental earnings by spending it following your economic objectives. There are various tax benefits to real estate investing.

It will drastically decrease taxable income while decreasing the expense of real estate investing. Tax obligation reductions are supplied for a variety of costs, such as firm costs, cash flow from other properties, and home loan passion.

Property's link to the other main property groups is breakable, sometimes even adverse. Realty might as a result minimize volatility and increase return on danger when it is included in a portfolio of numerous assets. Compared to other assets like the stock click this market, gold, cryptocurrencies, and banks, purchasing property can be substantially safer.

Getting The Real Estate Reno Nv To Work

The supply market is continuously changing. The real estate sector has expanded over the previous numerous years as a result of the execution of RERA, decreased home financing rate of interest, and other elements. Real Estate Reno NV. The rate of interest on financial institution financial savings accounts, on the various other hand, are low, especially when compared to the climbing inflation

Report this page